Tax Impact

Updated with new information on the Ag2School Credit on March 28

GFW Public Schools aims to keep taxes low while providing a top-notch educational experience for our students and important services to all the members of our community. Each question has a different tax impact, and the district will provide the opportunity to revoke and replace the operating levy at an upcoming election in November if a PreK-12 single site option moves forward.

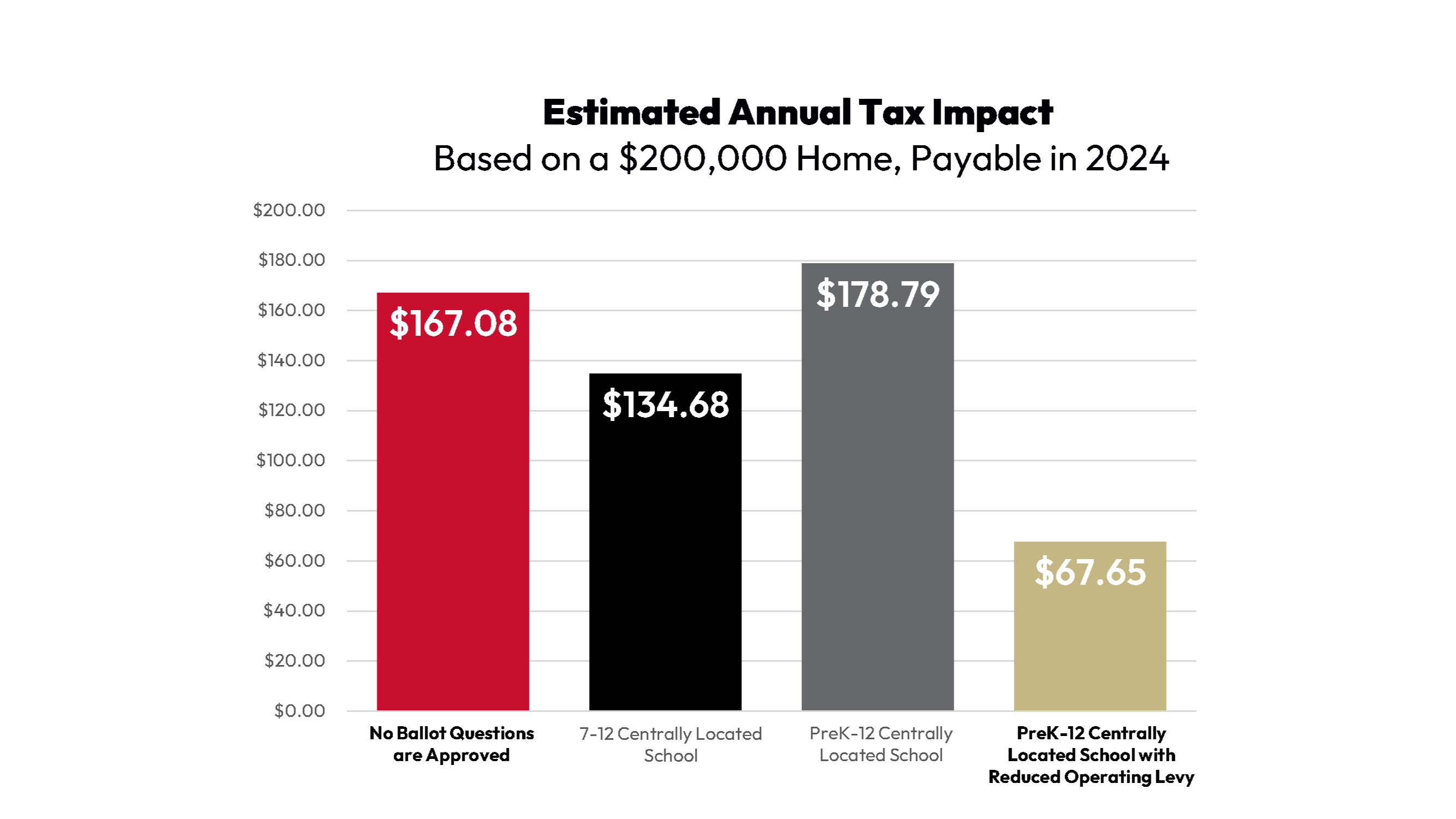

Tax Impacts at a Glance

Tax Impacts for all options are below. If both questions are approved and combined with an upcoming operating levy reduction, a $200,000 home in the district will see a tax increase of $5.63 per month or $67.65 per year.

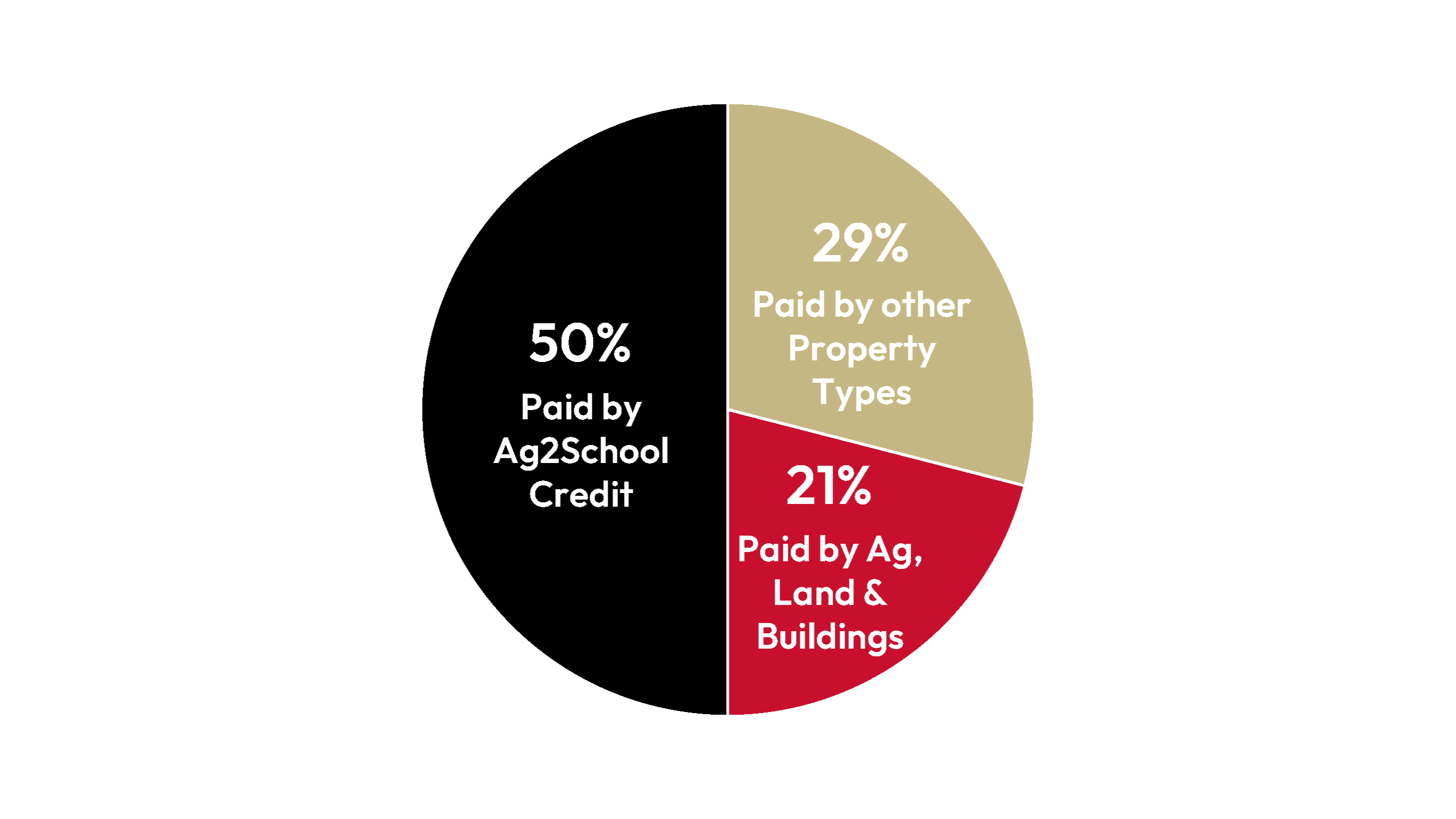

Ag2School Credit Explained

The Ag2School Credit is a law with strong bipartisan support that offsets 70% of facility bond costs to agricultural property. At the current rate, the Ag2School credit would cover 50% of the total bond cost for a PreK-12 facility with 71% of the GFW tax base eligible for the credit.

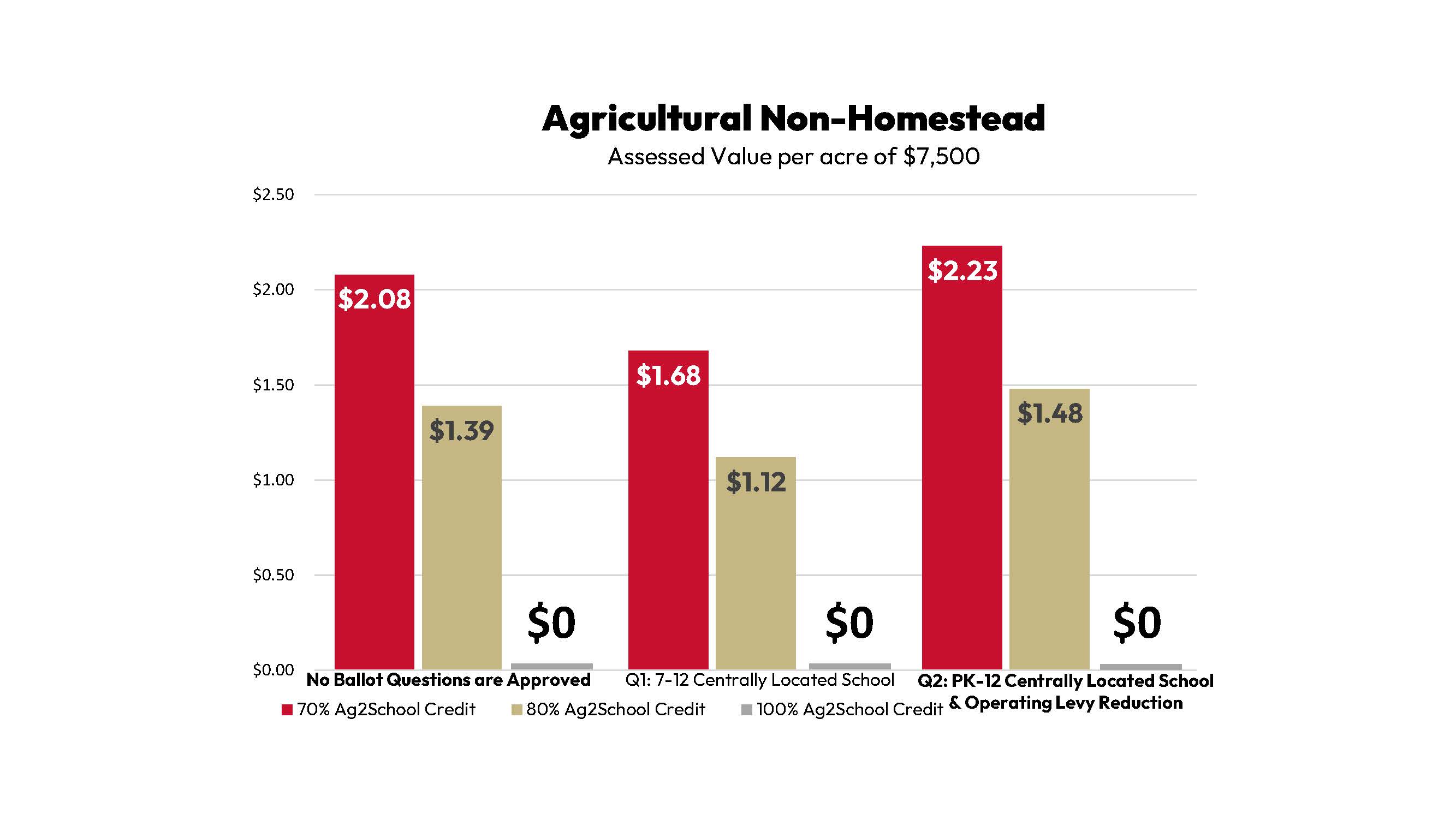

Governor Walz is calling to increase the Ag2School tax credit to 80%, with the house and senate both proposing an increase to 100%. The increase will be retroactive and impact owners of agricultural property regardless of when the project began.

If the credit is increased to 100% as proposed by the bills, 71% of a building project would be covered by the State.

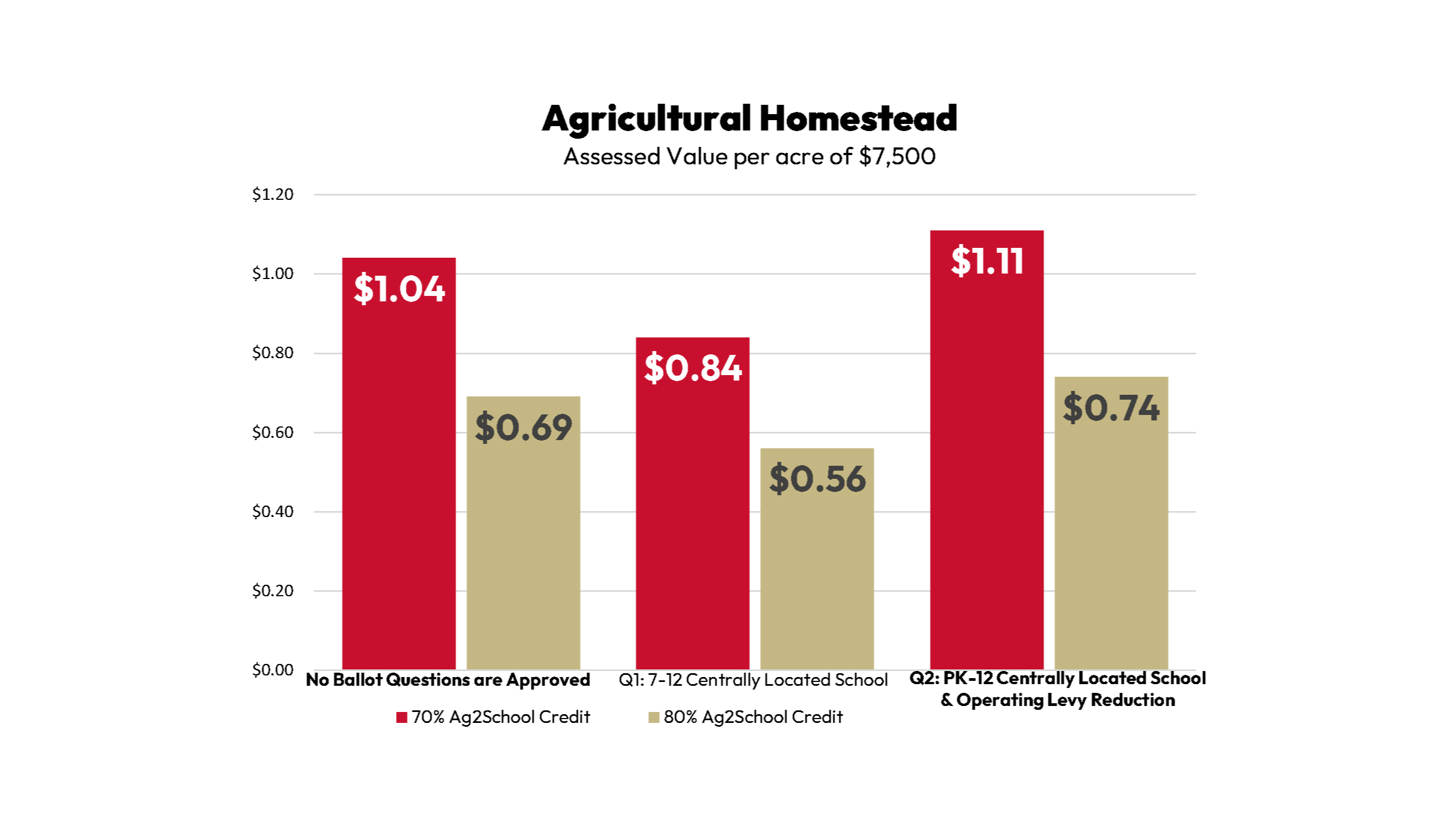

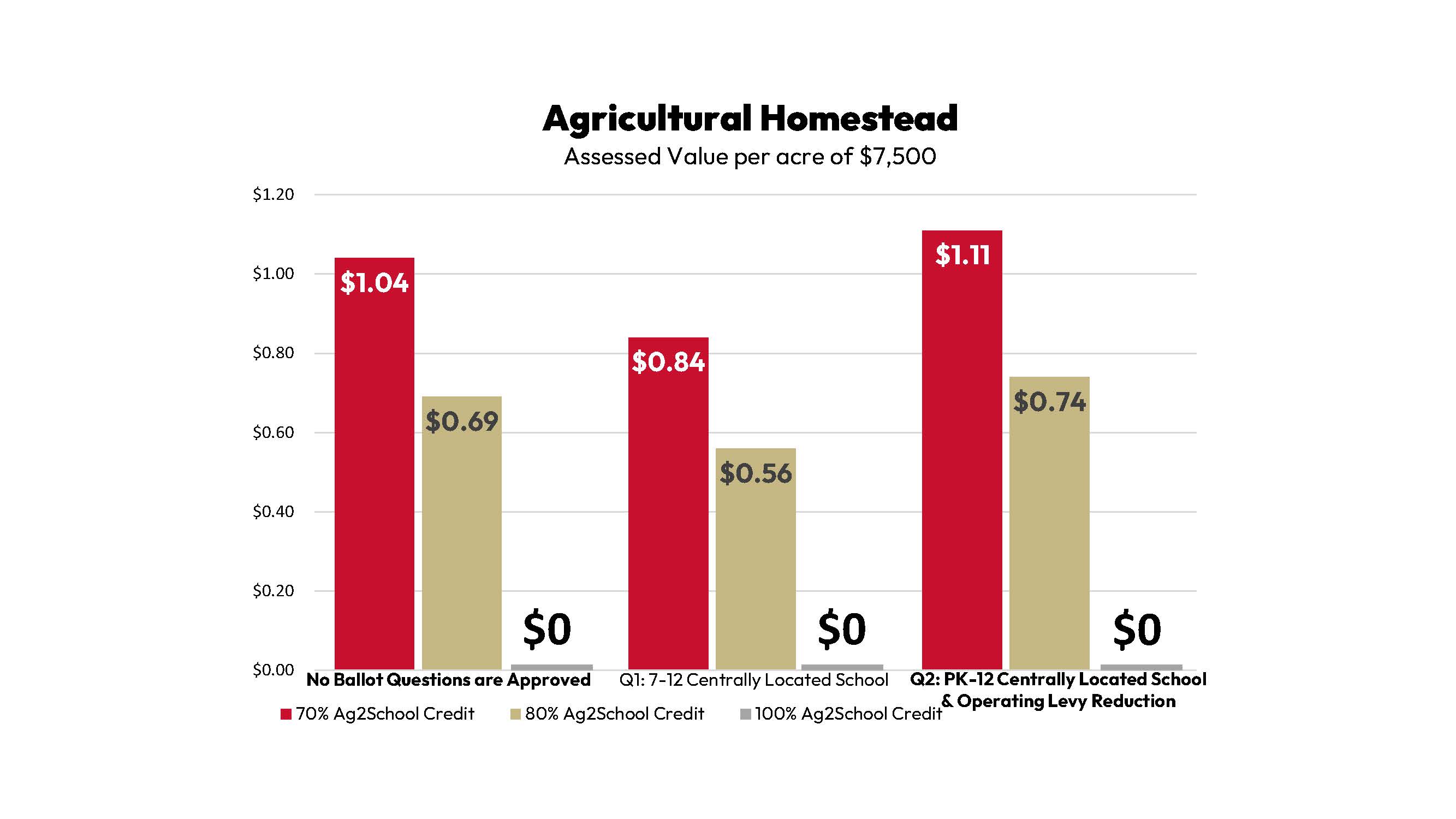

Relief for Agricultural Properties

There has been strong support for increasing the credit, including a proposal to increase it to 85% during the last legislative session. Governor Walz is now calling to increase it to 80% with legislators largely supporting an increase.

Even more exciting, there are bills in both the house and the senate (HF 1568 and SF 2929) with authors from both parties that propose to raise the Ag2School Credit to 100%. This credit is simply not going away and if these bills move forward, our farmers will greatly benefit.

Homesteaded Property Tax Impacts

Governor Walz is calling to increase the Ag2School tax credit to 80%, with the house and senate both proposing an increase to 100%.

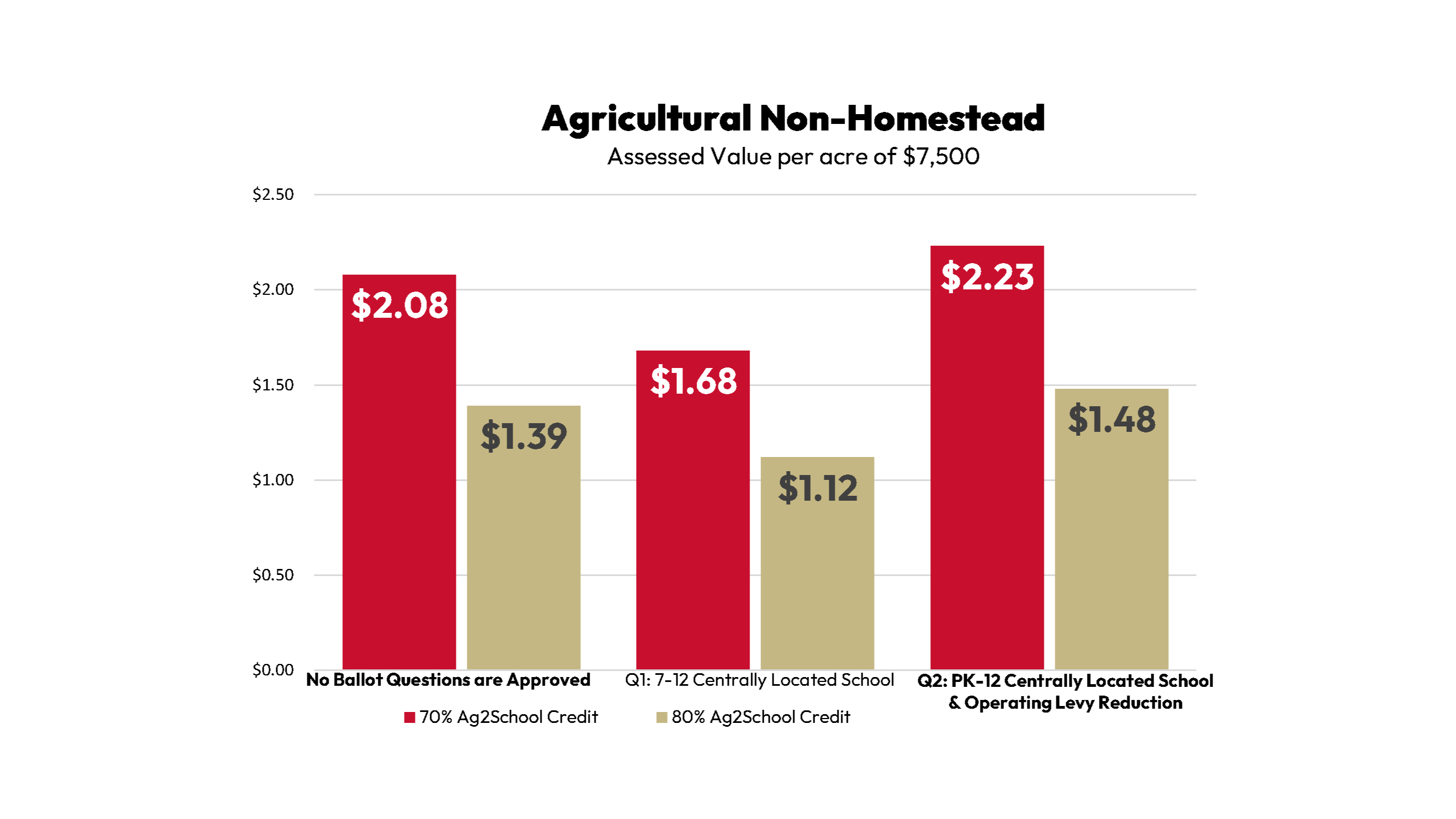

Non-Homesteaded Property Tax Impacts

Governor Walz is calling to increase the Ag2School tax credit to 80%, with the house and senate both proposing an increase to 100%.

Tax Impact Comparisons for All Options

No Ballot Questions are approved | Question 1 7-12 Centrally Located School | Question 2 PreK-12 Centrally Located School and Operating Levy Reduction* | |

|---|---|---|---|

Plan | $43 Million Capital Improvement Plan School Board Approved December 12, 2022 | $55 Million | $69.9 Million ($14.9 Million over Q1) |

Residential Homestead with Estimated Market Value of $200,000 | $167.08 annual impact | $134.68 annual impact | $67.65 annual impact |

Agricultural Homestead (assessed value per acre of $7,500) | $1.04 annual impact per acre factored at 70% Ag2School Credit $.69 annual impact per acre factored at 80% Ag2School Credit | $.84 annual impact per acre factored at 70% Ag2School Credit $.56 annual impact per acre factored at 80% Ag2School Credit | $1.11 annual impact per acre factored at 70% Ag2School Credit $.74 annual impact per acre factored at 80% Ag2School Credit |

Agricultural Non-Homestead (assessed Value per acre of $7,500) | $2.08 annual impact per acre factored at 70% Ag2School Credit $1.39 annual impact per acre factored at 80% Ag2School Credit | $1.68 annual impact per acre factored at 70% Ag2School Credit $1.12 annual impact per acre factored at 80% Ag2School Credit | $2.23 annual impact per acre factored at 70% Ag2School Credit $1.48 annual impact per acre factored at 80% Ag2School Credit |

*Operating levy reduction to be on November 2023 ballot

**Tax Impact represented reflects the increase in taxes payable 2023 to taxes payable 2024

Question 1 - Construction of 7-12 Facility in Centralized Location

Question 1 will have voters consider the option to construct a centrally located 7-12 facility ($55 million) as a first step towards an eventual transition to a centrally located PreK-12 facility. This option would result in two schools operating in the district.

Funding would be repaid over 25 years

The district would need to use existing LTFM and other methods to repair the current elementary school.

This option would not include the option to reduce the operating levy due to the additional costs of operating multiple buildings

Tax Impact of $55 Million Centralized 7-12 Facility

Residential Homestead with Estimated Market Value of $200,000 | Agricultural Homestead (assessed value per acre of $7,500) | Agricultural Non-Homestead (assessed Value per acre of $7,500) |

|---|---|---|

$134.68 annual impact | $0.84 annual impact | $1.68 annual impact |

Question 2 - Construction of PreK-12 Facility in Centralized Location

Voters will also consider the option to approve an additional $14.9 Million over the cost to build a 7-12 facility to construct a centralized PreK-12 single site. This would result in one school facility for all grades in the district. Funding would be repaid over 29 years. Because this option would result in operational savings due to operating a single site, the district will allow voters to consider revoking and replacing the current operating levy at a reduced rate to offset the costs and pass savings along to the taxpayer via an election in November 2023.

Tax Impact of $69.9 Million Centralized PreK-12 Facility with Reduced Operating Levy

Residential Homestead with Estimated Market Value of $200,000 | Agricultural Homestead (assessed value per acre of $7,500) | Agricultural Non-Homestead (assessed Value per acre of $7,500) |

|---|---|---|

$67.65 annual impact | $1.11 annual impact | $2.23 annual impact |

$43 Million Capital Improvement Plan - Beginning November 2023

School districts have multiple financing options, and the GFW School Board has the authority to approve up to $43 million in funding without voter approval. The board approved this plan to take effect in November of 2023 as a solution if a long-range plan is not approved by voters.

While this total would not address all district needs, a timeline of phased projects could maintain current facilities while the district and community work together to approve a long range plan. Funding would be repaid over 15 years and the Ag2School Credit would not apply to all sections of the plan.

Tax Impact of $43 Million Capital Improvement Plan

Residential Homestead with Estimated Market Value of $200,000 | Agricultural Homestead (assessed value per acre of $7,500) | Agricultural Non-Homestead (assessed Value per acre of $7,500) |

|---|---|---|

$167.08 annual impact | $1.04 annual impact | $2.08 annual impact |